AIM Uncovered

Exploring the latest insights and trends in technology and innovation.

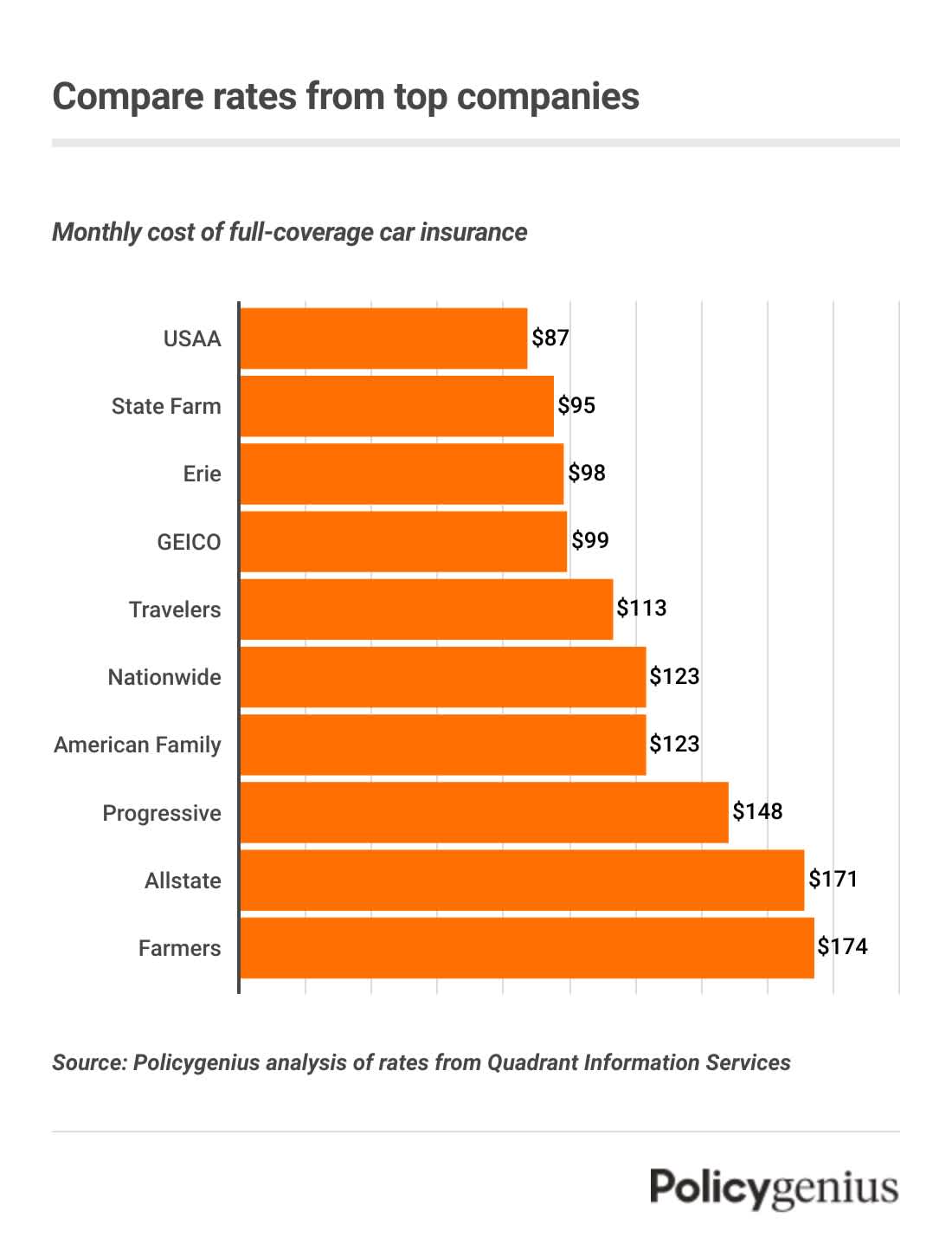

Insurance Smackdown: Battle of the Best Rates

Uncover the ultimate insurance showdown! Discover unbeatable rates and tips to save big in the Insurance Smackdown. Don’t miss out!

Top 10 Tips for Finding the Best Insurance Rates

Finding the best insurance rates can be a daunting task, but with the right approach and a little patience, you can save a significant amount of money. Start by shopping around; obtain quotes from multiple insurance providers to compare prices and coverage options. Additionally, consider using online comparison tools which can help you quickly identify competitive rates. It's also wise to check for any discounts that may apply to your situation, such as bundling policies or maintaining a good driving record.

Another important tip is to review your policy regularly. Life changes, such as marriage, moving, or acquiring new assets, can affect your insurance needs and premiums. Stay informed about the deductibles and coverages you have, as adjusting these can often lead to more favorable rates. Lastly, don't hesitate to negotiate with your insurer; a polite inquiry about lowering your rates can sometimes yield surprising results.

Is Bundling Your Insurance Policies Worth the Savings?

When it comes to managing your finances, bundling your insurance policies can be an appealing option. By consolidating multiple insurance products, such as home, auto, and life insurance, into a single policy with one insurer, you often unlock significant savings. Many insurance companies offer discounts to customers who choose to bundle their policies, which can lead to lower premium costs. This strategy not only saves you money but also simplifies your financial management, giving you a single point of contact for all your insurance needs.

However, it's essential to weigh these savings against the potential downsides. Bundling your insurance policies may limit your options in the marketplace, as you might not be able to shop around for the best coverage suited to your specific needs. Additionally, locking in with one provider doesn't guarantee that they will always offer the most competitive rates. Therefore, it's crucial to evaluate your overall insurance needs and perform due diligence. Consider getting quotes from separate insurers and comparing them to your bundled offer to ensure you're making the best choice for your financial situation.

What Factors Influence Your Insurance Premiums?

Understanding the factors that influence your insurance premiums is essential for making informed decisions about your coverage. Several key elements come into play, including your age, location, and overall risk profile. For instance, younger drivers often face higher car insurance premiums due to their limited driving experience, while individuals in urban areas might pay more due to increased traffic and accident rates. Additionally, insurers evaluate your claims history; those with a record of frequent claims are likely to see elevated premiums.

Another significant factor is the type of coverage you choose. Comprehensive coverage typically costs more than a basic policy because it includes more protections. Moreover, factors such as the make and model of your vehicle, your credit score, and the amount of your deductible also influence the final cost. For example, opting for a higher deductible often results in lower premiums, but it also means you will pay more out of pocket if you need to file a claim. Understanding these elements can help you effectively manage and potentially reduce your insurance costs.