AIM Uncovered

Exploring the latest insights and trends in technology and innovation.

Why Term Life Insurance is the Adulting Decision You Didn't Know You Needed

Discover why term life insurance is the ultimate adulting hack you never knew you needed. Secure your future effortlessly today!

The Top 5 Reasons Term Life Insurance is Essential for Your Financial Future

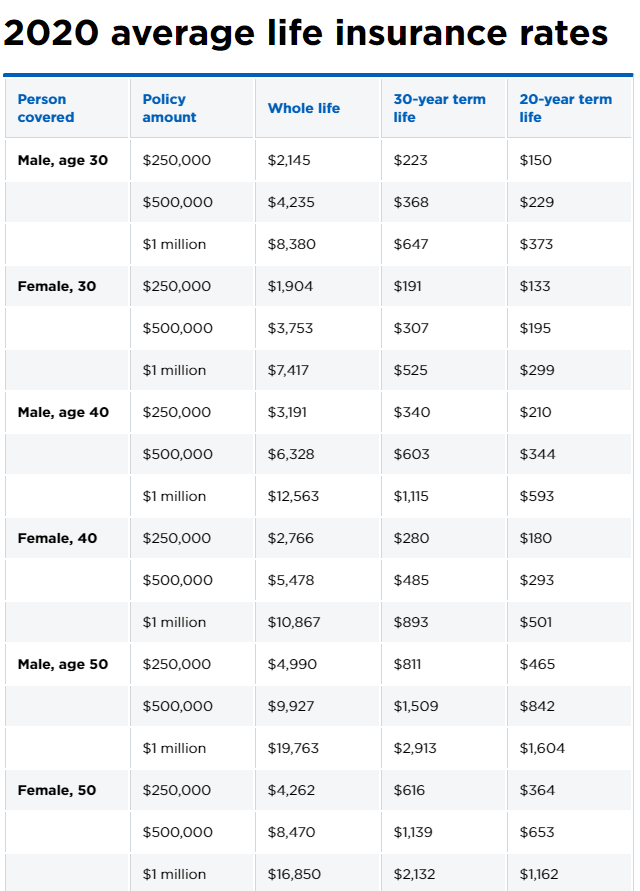

Term life insurance is a crucial component of a well-rounded financial plan, providing peace of mind for you and your loved ones. One of the top reasons to consider it is affordability; compared to other types of life insurance, term life offers lower premiums, making it accessible for most families. Additionally, it provides a significant death benefit that can help cover expenses such as mortgages, education costs, and daily living expenses if the unexpected happens.

Another compelling reason is that term life insurance can serve as a financial safety net during key life stages. For young families, it ensures that loved ones are protected during critical years. Moreover, it often allows for convertible options, enabling you to transition to permanent insurance later in life without undergoing additional health evaluations. In summary, the top 5 reasons to invest in term life insurance revolve around its affordability, flexibility, and the essential coverage it provides to secure your family's financial future.

Term Life Insurance 101: Understanding the Basics and Benefits

Term life insurance is a type of life insurance policy that provides coverage for a specified period, typically ranging from 10 to 30 years. Unlike permanent life insurance, which lasts for the policyholder's lifetime, term life insurance is designed to cover individuals for a limited time, making it a more affordable option for many. When purchasing a term life policy, it is essential to assess your financial needs, including coverage amount and term length, to ensure that your loved ones are protected in the event of your untimely passing.

One of the primary benefits of term life insurance is its affordability. Premiums for term policies are generally lower than those for whole or universal life insurance, making it an attractive option for young families or individuals looking to secure coverage without straining their budgets. Additionally, term life insurance offers the flexibility of converting to a permanent policy if your circumstances change, allowing you to adapt your coverage as needed. Ultimately, understanding these basic principles of term life insurance can help you make informed decisions about your financial future and the protection of your beneficiaries.

Is Term Life Insurance Right for You? Here’s What You Need to Know

When considering whether term life insurance is right for you, it's essential to evaluate your financial situation and personal needs. This type of insurance offers coverage for a specified period, usually ranging from 10 to 30 years. If you have dependents or significant debts, such as a mortgage, term life insurance can provide peace of mind by ensuring that your loved ones are financially protected in the event of your untimely passing. It’s often more affordable than permanent life insurance, making it an attractive option for those seeking temporary coverage without the complexity of a lifelong policy.

To determine if term life insurance fits your circumstances, consider the following factors:

- Your current financial obligations, including debts and living expenses.

- The number of dependents who rely on your income.

- Your overall financial goals and how insurance aligns with them.

- The length of time you need coverage, based on your life stage and responsibilities.

Ultimately, evaluating these elements can help you decide if opting for term life insurance is the best strategy for safeguarding your family’s financial future.