AIM Uncovered

Exploring the latest insights and trends in technology and innovation.

Why Paying Less for Insurance Doesn't Have to Mean Compromising Coverage

Discover how to save on insurance without sacrificing coverage—boost your savings while staying protected!

Maximizing Coverage: How to Save on Insurance Without Sacrificing Quality

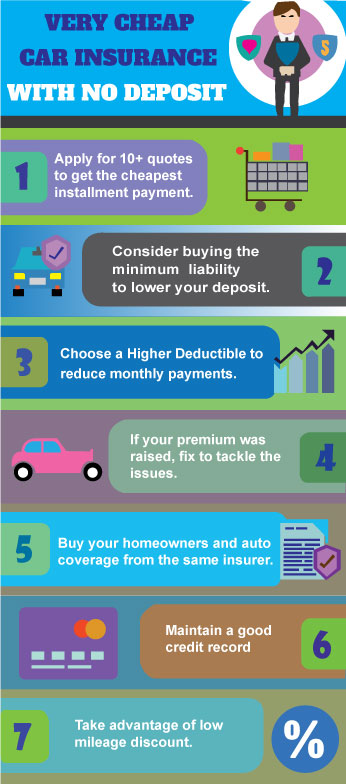

When it comes to maximizing coverage while saving on insurance, understanding your policy options is crucial. Begin by reviewing your current coverage to identify any areas where you might be over-insured. Assess your needs based on your individual circumstances, such as the value of your assets and potential liabilities. Focus on high-deductible plans for health or auto insurance; they often come with lower premiums, allowing you to keep costs manageable while ensuring a safety net in case of emergencies.

Additionally, consider bundling your policies to take advantage of multi-policy discounts. Many insurance providers offer reduced rates when you combine different types of coverage, such as home and auto. Don't hesitate to shop around and compare quotes from multiple providers, as this could lead to substantial savings. Lastly, maintaining a healthy credit score and asking about available discounts—like those for safe driving or loyalty—can further enhance your coverage options without compromising on quality.

The Truth About Budget Insurance: What You Need to Know

Budget insurance often seems like an attractive option for those looking to save on premiums while still obtaining coverage. However, it’s crucial to understand what you may be sacrificing in terms of protection and service. Many budget insurance providers may cut corners by offering limited coverage options, higher deductibles, or insufficient customer support. Before opting for a budget policy, assess your specific needs and research what is included and excluded in the plan. This will help prevent unpleasant surprises in the event that you need to file a claim.

Another important aspect to consider is that budget insurance often comes with strict limitations and conditions. For instance, certain types of claims might be entirely excluded or only partially covered, depending on the fine print. It’s essential to thoroughly read through the policy and grasp the terms and conditions. Additionally, comparing multiple quotes and policies not only helps you identify potential savings but can also give you a better idea of what level of coverage you can realistically afford. In the long run, investing a little extra in comprehensive insurance could save you from significant financial strain down the road.

5 Tips for Finding Affordable Insurance That Still Offers Great Coverage

Finding affordable insurance that still offers great coverage can be a challenging task. However, by doing your homework and seeking options wisely, you can secure a policy that meets both your needs and budget. Researching various insurance providers is crucial, as prices and coverage can vary significantly. Start by creating a list of potential companies and comparing their offerings to find the most competitive rates without sacrificing quality.

Another effective strategy is to consider bundling multiple types of insurance together. Many insurers provide discounts when you purchase various policies, such as auto, home, or health insurance, from the same company. Additionally, don't hesitate to ask about any available discounts for your specific situation—such as safe driving records or loyalty discounts. Finally, remember to read the fine print of any policy to ensure that you are not missing out on coverage that could become invaluable in the future.