AIM Uncovered

Exploring the latest insights and trends in technology and innovation.

The Great Insurance Smackdown

Uncover the ultimate showdown of insurance providers! Discover the best policies, tips, and tricks to maximize your coverage and savings.

Understanding Different Types of Insurance: Which One is Right for You?

When it comes to navigating the world of insurance, understanding the different types available is crucial to finding the right coverage for your needs. Insurance can be broadly categorized into several types, including life insurance, homeowners insurance, auto insurance, and health insurance. Each of these types serves a distinct purpose. For example, life insurance provides financial security for your dependents in the event of your untimely passing, while health insurance covers your medical expenses and ensures access to necessary healthcare services.

To determine which type of insurance is suitable for you, consider your individual circumstances and needs. For instance, if you own a home, homeowners insurance is vital to protect your investment against damages and liabilities. On the other hand, if you have dependents, prioritizing life insurance might be essential to safeguard their financial future. It's imperative to conduct thorough research and possibly consult with an insurance professional to tailor a plan that fits your lifestyle and financial goals.

Top 5 Common Insurance Myths Debunked

When it comes to insurance, many people hold misconceptions that can lead to poor decision-making. One of the most prevalent myths is that all insurance policies are the same. In reality, there are various types of insurance tailored for different needs, such as health, auto, and homeowners insurance. Each policy comes with its own set of terms, conditions, and coverage limits, making it crucial for consumers to do their homework. For more detailed information, you can visit NAIC to understand the different types of insurance available.

Another common myth is that getting insurance is always too expensive. Many people avoid purchasing coverage due to perceived high costs, but options like subsidized health plans and state programs can significantly reduce your premiums. Additionally, there are many resources available to help consumers find affordable options that meet their needs. Understanding your eligibility for different programs can help shed light on how affordable insurance can really be.

How to Choose the Best Insurance Policy for Your Needs

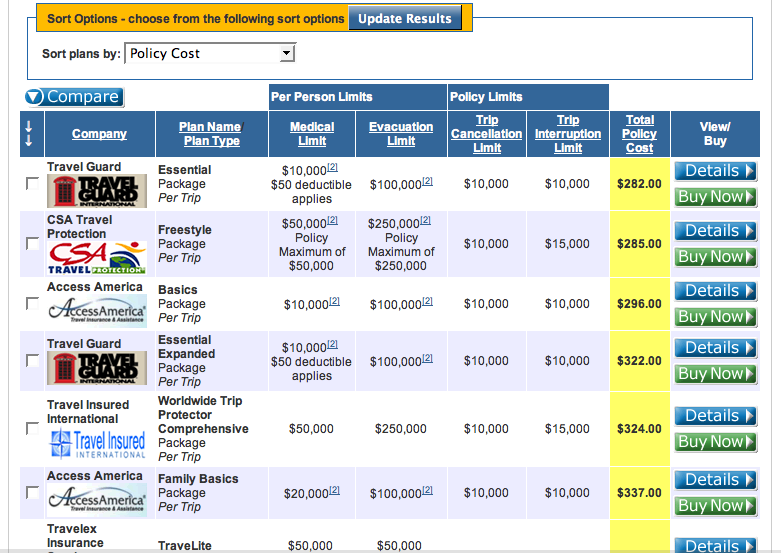

Choosing the best insurance policy for your needs involves a thorough assessment of your personal circumstances and financial goals. Start by identifying what types of coverage you require, whether it's health, auto, home, or life insurance. Research various providers and their offerings to compare premium rates, deductibles, and limits. Websites such as NerdWallet and Insure.com provide comprehensive comparisons and reviews that can aid your decision-making process.

After narrowing down your options, consult with a licensed insurance agent who can offer personalized insights based on your specific needs. Remember to read the policy fine print carefully; it often contains crucial details regarding exclusions and limitations. Finally, consider the customer service reputation of the insurer by checking ratings on platforms like J.D. Power to ensure that you choose a provider that supports you when you need it most.