AIM Uncovered

Exploring the latest insights and trends in technology and innovation.

Insurance Roulette: Spin the Wheel of Savings

Unlock amazing savings with Insurance Roulette! Spin the wheel for exclusive deals and tips to lighten your insurance load today!

Maximize Your Savings: How Insurance Roulette Can Lower Your Premiums

In the world of personal finance, maximizing your savings is crucial, and one effective method that has emerged is insurance roulette. This strategy involves regularly reassessing and changing your insurance providers to find the best deals. By shopping around, you can compare premiums and coverage options, ensuring that you are not overpaying for your policies. This dynamic approach not only keeps you informed about the market but also allows you to take advantage of promotional offers that can significantly lower your costs.

Moreover, insurance roulette requires you to be proactive about your coverage needs. Consider evaluating the types of insurance you hold—be it auto, home, or health insurance—and identify any overlaps or unnecessary policies. By consolidating your coverage with a single provider or opting for appropriate plans tailored to your lifestyle, you can effectively reduce your premiums. Remember, taking time to play the insurance game can lead to increased savings and a more secure financial future.

Understanding the Odds: What You Need to Know Before Spinning the Wheel of Savings

When considering spinning the wheel of savings, it's essential to understand the odds associated with each spin. Each wheel may present different opportunities for rewards, promotions, or discounts, but not all are created equal. Take a moment to analyze the various options available:

- Potential Rewards: What can you win?

- Chances of Winning: What are the odds?

- Eligibility: Are there any restrictions?

Before you dive into the excitement of spinning the wheel of savings, consider setting a budget for yourself. It's easy to get caught up in the thrill of the spin, but a clear budget will help you avoid overspending. Additionally, keep in mind that while winning can be exhilarating, not every spin will result in a reward. Reflect on the odds and manage your expectations to ensure that your experience remains enjoyable and financially beneficial. Remember, informed participation is key!

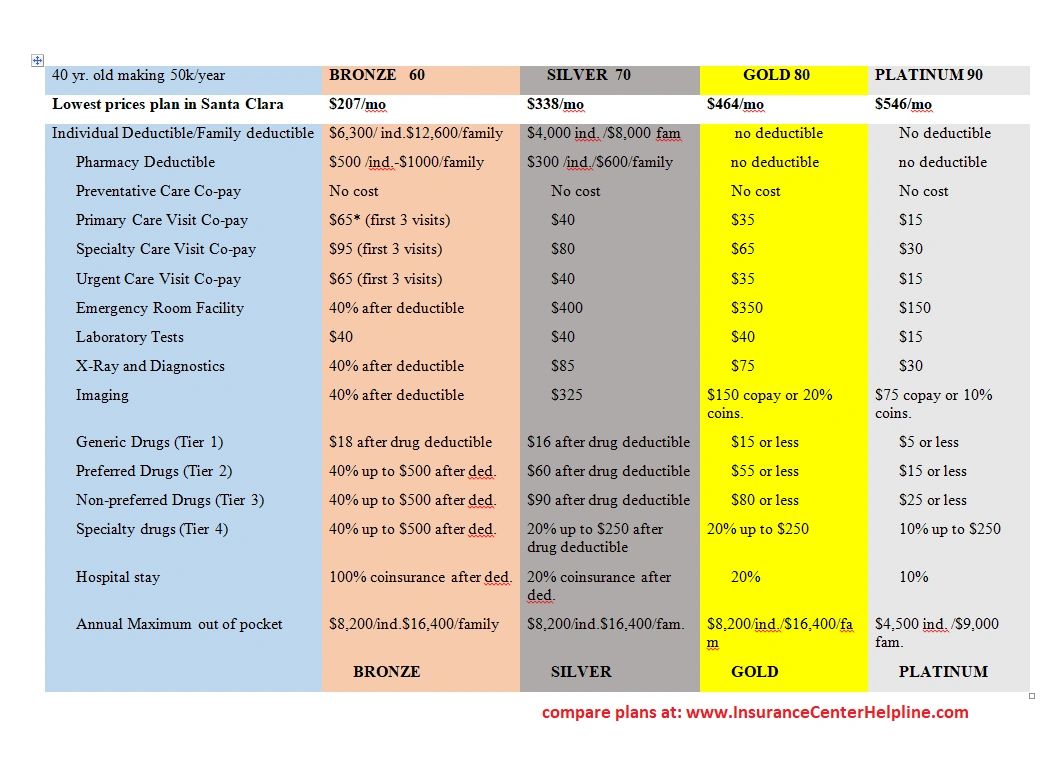

Are You Playing the Right Game? Comparing Insurance Options for the Best Deal

When considering your insurance needs, it's important to ask yourself, Are you playing the right game? The insurance market is vast, with a multitude of options available that can cater to your unique situation. To ensure you're selecting the best plan, start by evaluating your specific requirements. Create a list of essentials, such as coverage limits, premium costs, and deductibles. By comparing these factors across various providers, you can gain a clearer understanding of which policies might offer you the best deal.

Another key aspect of comparing insurance options is to look beyond just the price. Often, hidden features or limitations within policies can significantly impact the value you receive. Consider factors such as customer service ratings, claim processing efficiency, and the overall reputation of the insurer. By prioritizing these elements, you can make an informed decision that truly reflects your needs and ensures that you're not merely getting the cheapest option, but rather the best value for your investment.