AIM Uncovered

Exploring the latest insights and trends in technology and innovation.

Life's Safety Net: Why Term Life Insurance Might Be Your Best Bet

Discover why term life insurance could be your best financial safety net. Protect your loved ones today and secure your peace of mind!

Understanding Term Life Insurance: Key Benefits and Considerations

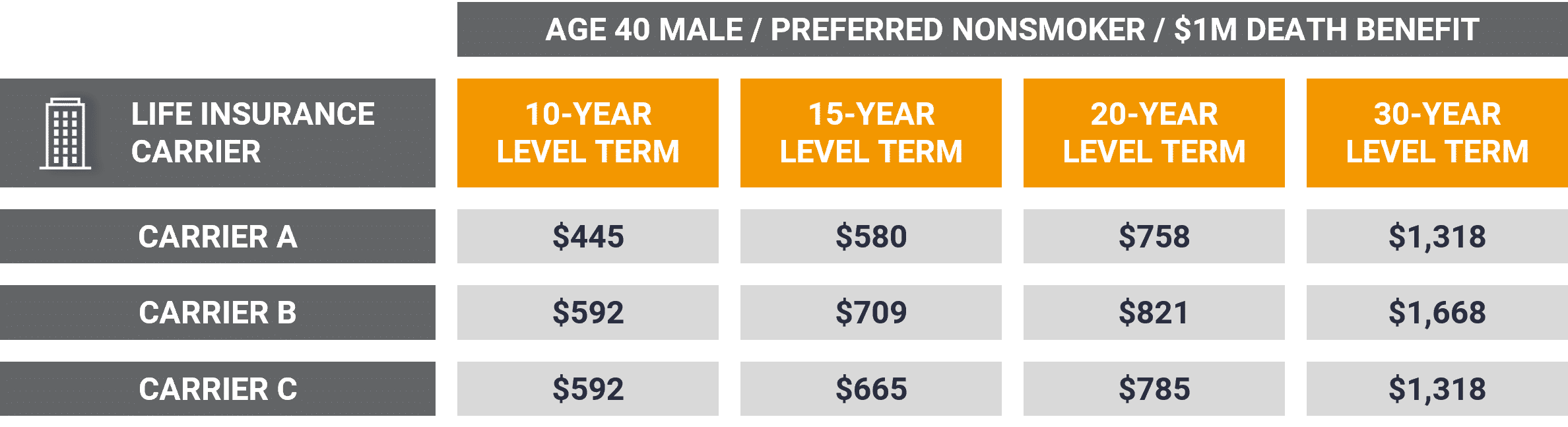

Term life insurance is a straightforward and affordable option for those seeking financial protection for their loved ones. It provides coverage for a specified period, typically ranging from 10 to 30 years, and pays out a death benefit if the insured passes away within that term. One of the key benefits of term life insurance is its cost-effectiveness; premiums are generally lower than those of permanent life insurance policies. This makes it an attractive choice for younger individuals or families looking to secure their financial future without breaking the bank.

When considering term life insurance, it is essential to evaluate your personal needs and financial goals. A few important factors to consider include:

- The duration of coverage: Decide how long you need protection based on your life stage, such as raising children or paying off a mortgage.

- Financial obligations: Assess your debts and dependents' needs to determine the appropriate death benefit amount.

- Renewal options: Check if the policy allows for renewal or conversion to a permanent policy later on.

Is Term Life Insurance Right for You? Essential Factors to Consider

When considering whether term life insurance is right for you, it’s important to assess your personal circumstances and financial goals. Start by evaluating the coverage needs of your family. Ask yourself questions like: How much would my loved ones require to maintain their standard of living if I were no longer around? Do they have existing savings or other forms of financial support? Additionally, consider your current debts, such as mortgages or student loans, that could impose a burden on your beneficiaries in your absence.

Another essential factor is the duration of coverage you will need. Term life insurance is designed to provide financial protection for a specific period, usually ranging from 10 to 30 years. If you anticipate that your financial responsibilities, such as raising children or paying off a home, will decrease over time, this type of policy may be suitable for you. However, if you pursue long-term coverage or have significant lifelong financial commitments, you may want to explore permanent life insurance options as well.

How Term Life Insurance Can Provide Financial Security for Your Loved Ones

Term life insurance serves as a fundamental financial safety net for families, ensuring that your loved ones are protected in the event of an unforeseen tragedy. By providing a death benefit that can help cover essential expenses such as mortgage payments, education costs, and daily living expenses, term life insurance alleviates the financial burden during an emotionally challenging time. This type of policy is particularly appealing due to its affordability and straightforward structure, allowing individuals to select a coverage period that aligns with their financial needs and life goals.

In addition to offering peace of mind, term life insurance can play a pivotal role in long-term financial planning. For families with growing children or aging parents, securing a term policy can ensure that their dependents maintain their quality of life, regardless of what happens. Moreover, term life insurance can be a strategic part of an overall financial plan, allowing individuals to allocate their resources effectively over time while still guaranteeing financial security for their loved ones. By investing in a policy now, you take a proactive step towards safeguarding your family's future.