AIM Uncovered

Exploring the latest insights and trends in technology and innovation.

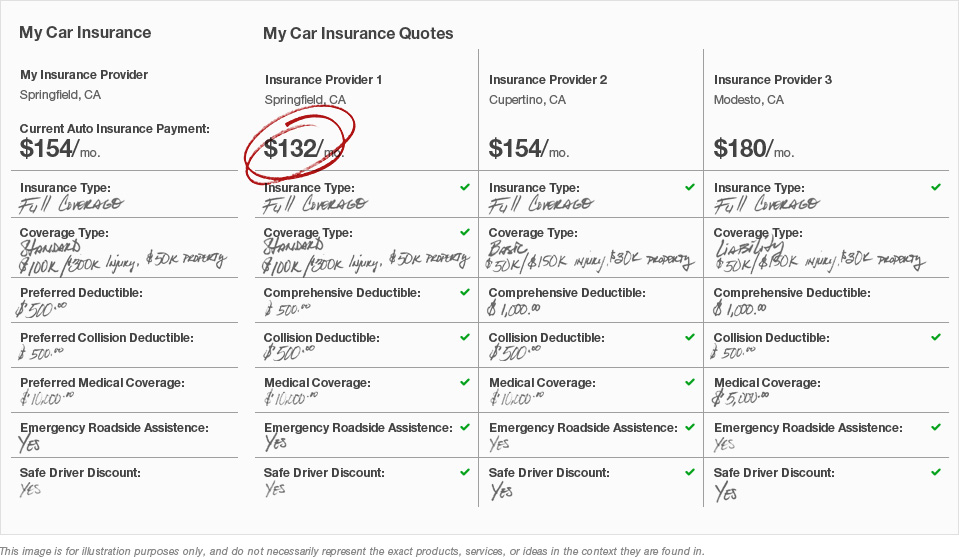

The Insurance Duel: Who Will Save You More?

Discover the showdown between insurance giants! Uncover which one truly saves you more money in our ultimate comparison.

Exploring the Cost Differences: Which Insurance Provider Offers the Best Value?

When it comes to insurance providers, evaluating the cost differences is crucial for finding the best value for your needs. Different insurance companies offer varying premium rates based on factors such as coverage options, customer service, and claim handling processes. To make an informed decision, it's essential to compare quotes from multiple providers. Consider creating a list of potential insurers and their offerings, which will allow you to easily identify any significant price variations. Additionally, look at customer reviews for insights regarding their satisfaction and the overall value they received.

Another vital aspect to consider is the discounts offered by each insurance provider. Many companies provide various savings opportunities based on factors like bundling policies, safe driving records, or being a member of certain organizations. It's beneficial to inquire about these discounts when obtaining quotes. Ultimately, understanding the cost differences not only helps you identify which insurance provider offers the best value but also ensures you are getting the coverage you need without overpaying. By doing your homework, you can secure a policy that meets your budget and coverage requirements effectively.

Insurance Showdown: How to Choose the Right Coverage for Your Needs

When it comes to selecting the right insurance coverage, it can feel overwhelming due to the sheer variety of options available. To simplify your decision-making process, start by assessing your specific needs and priorities. Take note of crucial factors such as your financial situation, lifestyle, and any existing policies you may have. Additionally, creating a list of potential risks you want to cover can greatly assist in narrowing down your choices. Consider vital categories such as health, auto, home, and life insurance, and rank them in order of importance to your overall well-being.

Once you have a clear idea of what you need, it's essential to shop around and compare multiple insurance providers. Different companies offer various coverage options, limits, and pricing structures that can significantly impact your wallet. Use online comparison tools, request quotes, and read customer reviews to gain insights into each provider's reliability and customer service. Ultimately, taking the time to thoroughly evaluate each option will help you transform the daunting task of insurance selection into a more manageable and informed process.

The Ultimate Guide to Insurance Savings: Tips and Tricks for Affordable Coverage

Finding affordable coverage can be a daunting task, but with the right strategies, you can significantly reduce your insurance costs. Start by shopping around and comparing quotes from multiple insurers to find the best rates. According to industry experts, bundling different types of insurance, such as home and auto, can often lead to substantial discounts. Additionally, consider increasing your deductibles, which generally lowers your premiums. Don't forget to check for any available discounts, such as safe driver discounts or affiliations with certain organizations!

Another effective strategy for maximizing your insurance savings is to regularly review your policies. Life changes, such as moving to a new home or buying a new car, can impact your coverage needs and premiums. Take the time to reassess your coverage levels and see if you can adjust them to better fit your current situation. Furthermore, maintaining a good credit score can also play a crucial role in lowering your insurance costs, as many providers use credit scores to determine rates. Remember, a little effort in understanding your policies can lead to significant savings over time!